Cape Town Municipal Valuations to be released shortly.

- Andrew Watt/Johan Cloete

- Feb 12, 2019

- 3 min read

Updated: Feb 19, 2019

Which Suburbs and Estates can expect the highest increases.

The Cape Town Municipality is planning to release its latest General Valuation roll on 21

February. This roll will update the current municipal property values and will form the basis

for calculating the new property rates that property owners will be charged from July 2019.

The City conducted valuations during 2018 and the resulting municipal values will replace

those currently in use which were last calculated in 2015.

Once the roll is released, property owners will have the opportunity to object to their

revaluation if they think their municipal valuation is too high. Objections can be made in

person until 29 March or online until 30 April. This is important because the impact of a

large increase in property rates could be the straw that breaks the camel’s back for Cape

Town property owners already enduring significant increases in electricity and water prices,

recent increases in VAT and personal tax rates and record fuel prices.

ValueCheck, a new online property valuation service, provides Cape Town property owners

access to a free service to check if their municipal property valuations are correct. If the

owner thinks that their valuation is too high, ValueCheck provides further low-cost

information and tools to assist the property owner to object to their municipal valuation.

According to the Municipal Property Rates Act, municipal valuations should reflect the

market value of a property at the time the valuation roll is conducted. With Cape Town

having experienced a mini-boom in property prices between 2015 and 2018, Lightstone

Property reports that for most areas, market values have increased between 20% and 40%

depending on location.

However, the recent experience of DA-controlled Johannesburg Municipality serves as a

warning to Cape Town residents about the importance of carefully monitoring municipal

property values. In its latest General Valuation roll update released last year, Johannesburg

aggressively increased its municipal property values by around 35% while market values

only increased by 23% over the same period. This resulted in increases in property rates

above 30% for properties valued above R2m. In many higher valued suburbs, the

experience was even worse with rates increasing by over 60%, leading Mayor Herman

Mashaba announce record municipal income shortly after the new rates came into effect.

To prepare Cape Town property owners for the upcoming General Valuation roll,

ValueCheck has released statistics predicting the municipal property value increases for

owners in different suburbs and gated estates. A summary of these statistics is provided

below while the full list of suburb and gated estate increases can be found at

www.valuecheck.co.za.

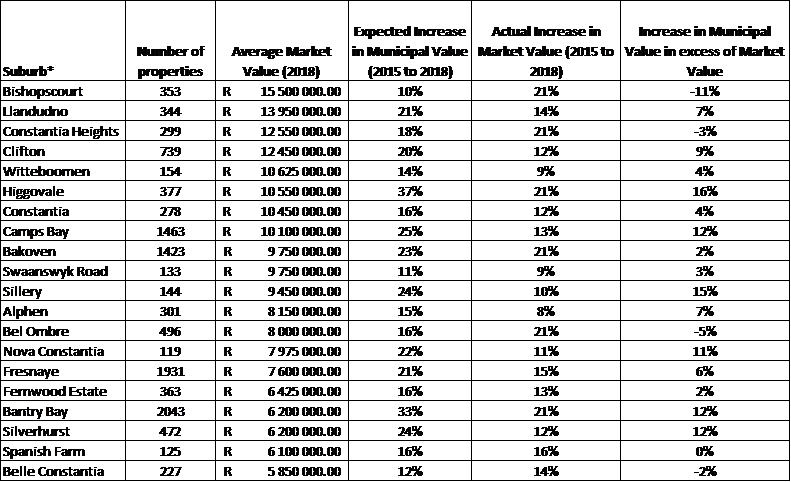

Suburbs where Municipal Increases most likely to exceed Market Value Increases..

ValueCheck predicts that a number of suburbs and estates are braced to experience much

higher municipal value increases than market value increases. This is driven partly by good

property price performance in these suburbs but more importantly possible municipal

undervaluations during the previous 2015 valuation roll. Below are the top 20 suburbs and

gated estates where ValueCheck expects municipal property value increases to exceed the

actual property price performance between the 2015 and 2018 valuation rolls.

Many of these suburbs and estates have seen significant development between 2015 and

2018 so the increase in municipal value is not surprising. However, this makes it even more

important to query the municipal value since values in these suburbs are trickier to

determine.

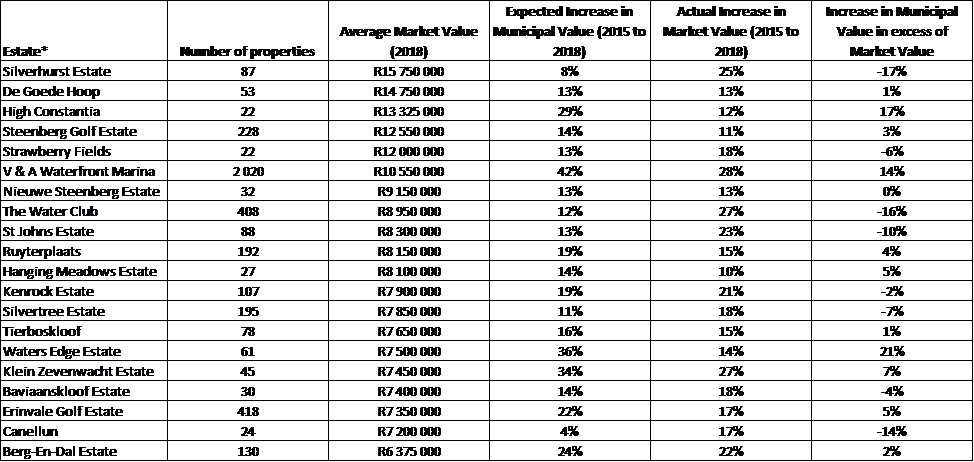

Predicted Increases in Municipal Values in elite suburbs and gated estates.

In addition to this, ValueCheck has released predictions on the increase in municipal values

expected in some of Cape Town’s most famous, high value suburbs and estates. The

suburbs picture is quite mixed with Higgovale, Camps Bay and Bantry Bay amongst those

likely to see punitive increases while Bishopscourt could get some relative relief. With

respect to gated estates, High Constantia, V&A Waterfront Marina and Waters Edge Estate could see significant municipal value increases while many others including Silverhurst, the

Water Club and St John’s Estate should see more modest increases.

ValueCheck Director, Johan Cloete, a qualified professional valuer with extensive property

valuation experience comments, “Ratepayers find the municipal rating process confusing

and don’t know how to fix valuation errors. We believe that our approach will increase the

transparency, efficiency in objection submissions and fairness of the general valuation

process for both rate payers and municipalities.” He adds, “It is important that objections

are submitted during the objection period because it is much harder and slower to get your

municipal valuation fixed once the objection period closes.”

Visit www.valuecheck.co.za to get your free property valuation and a step by step guide on

how to submit your objection.

Comments